Paramount's Best-Case ScenarioImagining a killer outcome for America's most denigrated entertainment conglomerateOnce again, it’s time to don my Dr. Robotnik mustache, transform into Megatron, and accelerate to warp speed, since we’re playing another round of “worst-case scenario” for a major entertainment company! If you can’t tell by the references above, it’s Paramount’s turn in the limelight. Frankly, the town has been assuming the worst-case scenario for Paramount Global — formerly ViacomCBS, and just Viacom and CBS before that — for years. Do you need me to tell you the problems facing them? Everyone wanted (and still wants) them to be sold for parts. My colleagues here at The Ankler believe some of this anger at Shari Redstone is that she dared to inherit her position and is thus deemed unqualified (you know, unlike the primogeniture of sons Lachlan Murdoch or Brian Roberts). But, hey, we’re not changing society here at The Ankler, just covering it. Anyway, let’s consider these accomplishments:

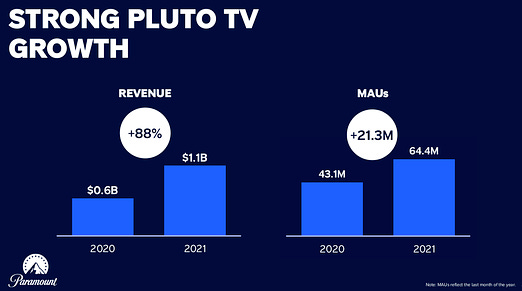

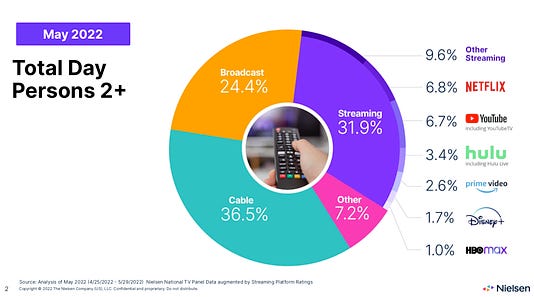

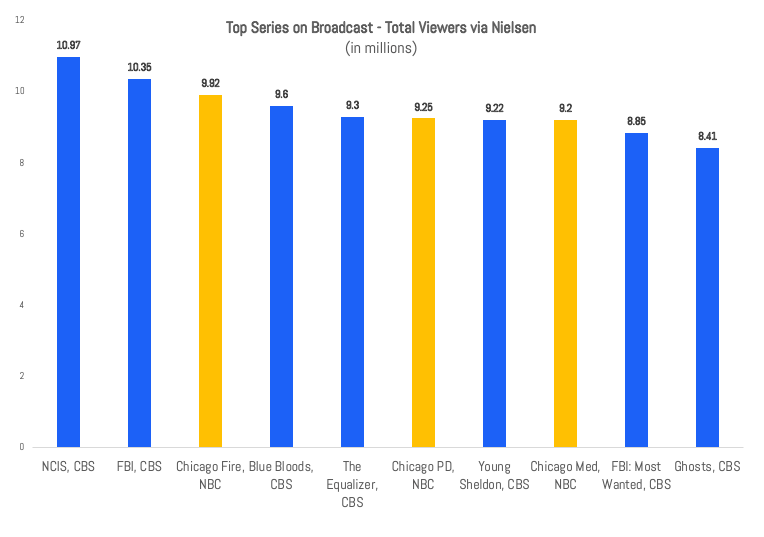

Dare I say Paramount+, usually the most denigrated of “major” movie studios-turned-conglomerates, is doing… well? They got Warren Buffett to invest, so he must see something! So we’re going into bizarro flip mode today. Instead of the worst case, let’s imagine Paramount’s best-case scenario over the next five to 10 years. It involves a smart global distribution strategy, winning the kids’ content wars and figuring out how to transfer CBS viewers to Paramount+. Laying it out, it’s not an easy path, but it's not inconceivable either. (Reminder: My best and worst-case scenarios are not predictions per se. Instead, they’re descriptions of potential outcomes, the tail ends of either the best or worst-case scenarios on a range of potential futures, with a five to 10 percent likelihood of happening. To catch the gist, read my worst-case takes on Disney, Amazon and Warner Bros. Discovery, as well as my early worst-case fears for Hollywood here [some of which came true].) First, Let’s Reiterate Industry-Wide Risks ⚠️When it comes to industry-wide risks — see my first worst-case scenario for details — Paramount has a similar profile to Disney and Warner Bros. Discovery: each would suffer from the death of either cable or theaters, and all lose revenue to global piracy. Whereas Disney and WBD have a bit more exposure to a decline in theaters and China pulling the plug on Western firms, Paramount probably has more exposure to the collapse of the linear TV bundle. CBS is, and has been, the biggest broadcast channel for years, meaning if broadcast viewers flee the linear TV bundle, they have the most to lose. Moreover, if the cable bundle shrinks, its cable channels (MTV, VH1, Comedy Central, BET... ) feel the least “must have” in the existing cable bundle. If cable dies sooner rather than later, then Paramount loses a valuable cash flow stream. But again we’re focusing on the positive today. So how do we flip this around? Perhaps the “death of cable” is slow and prolonged, more terminal illness than heart attack. (Or virtual MVPDs — virtual multi-channel video programming distributors — rise up to replace traditional MVPDs.) And it should go without saying that all the streamers need streaming to be not just viable but also very profitable, as opposed to the money-burning Now, Let’s Talk Potential: Company-Specific Upside 📈To really talk upside though, Paramount needs to do more than just ride positive trends; it needs a strategy that works, and works better than those of their competitors. Or I should say “strategies,” since taking the top spot in entertainment requires successful TV, film, distribution and product strategies. It should be noted that as of today, with a stock price of $24 a share, their market cap is around $16 billion, and they have another $13 billion in debt, meaning a total enterprise value of about $29 billion. That compares to Netflix’s EV of around $85 billion, Disney’s at $208 billion and Warner Bros.-Discovery at $44 billion. (All data from Yahoo Finance as of June 23, 2022.) Arguably, Paramount Global has the most upside of any of the pure-play entertainment firms. (And conversely Disney right now probably has the furthest to fall…) Here are the ways I think Paramount needs to succeed to live its best-case scenario: Step 1: Paramount Takes Back Its Kids’ Crown 👑It seems so long ago, but circa 2005, Viacom had the second-biggest kids brand in entertainment. Disney has been king since at least The Little Mermaid, but Nickelodeon was the cooler, edgier rival that dominated with Double Dare, Rugrats, and especially SpongeBob Squarepants. (Don’t sleep on Dora the Explorer either.) Eventually, it was dethroned, first by Cartoon Network taking market share in cable, and then Netflix stealing kids’ viewership outright. With the success of the Paw Patrol movie, Sonic the Hedgehog 2 and, again, SpongeBob, Paramount is well positioned to succeed in the kids’ programming space. Consider, SpongeBob had both a popular (for them) film on Paramount+ and, just two weeks back, made the Nielsen streaming rankings. In success, Paramount needs to retake its place in the pecking order behind Disney. Passing Netflix is tough, but with recent rumblings about its cost-cutting in animation, it’s not crazy. Especially as Disney, PBS, Apple and Netflix all compete to be the “good for kids and parents” brand, Nick could succeed as the alternate not-so-educational programming you watch when your parents aren’t looking. That’s on the TV side. With the film side, led by Brian Robbins who cut his teeth in the kids’ world, they just need to keep building kid franchises. Paramount Animation hasn’t set the world on fire yet, but it has some projects on well-known IP in the works (Teenage Mutant Ninja Turtles, Smurfs, Transformers and more SpongeBob). (The biggest risk in this strategy? As others would point out, kids TV has as many rivals on digital — Roblox, YouTube, Minecraft, Fortnite and TikTok — as it does with other streamers.) Step 2: Pluto TV Seizes its First-Mover Advantage 🥇For all the scorn heaped on Bob Bakish and Shari Redstone, to their credit they were well ahead of the curve when they bought PlutoTV for only $340 million in 2019. That looks like a steal now, especially as Netflix needs both ad-supported content and linear streaming. Paramount has touted the growth of its monthly active users on the free ad-supported streamer ever since: Now, skeptics could (and should) point out that MAUs (monthly active users) can be a misleading metric. And that advertising numbers on connected TVs have lots of problems. (A recent study said that 8-10 percent of ads delivered on “connected TVs” happen after the TV is shut off!) But ad-supported streaming is great for “lean back” content — remember when I said Netflix needed to put on its PANTS? — and Pluto TV provides Paramount an excellent option to monetize its deep catalogue of library shows and films. We don’t have great metrics for who is winning and losing the free-streaming wars yet, but some data put Pluto third or fourth place in the “free TV wars”, depending if you count The Roku Channel and Peacock. In other words, room to grow. Step 3: CBS Viewers Transition to Paramount+ ➡️It’s easy to forget just how much broadcast TV the average American watches, compared to streaming. According to Nielsen, Netflix makes up only 6 percent of TV consumption and broadcast is 24.4 percent. And CBS has the largest share of those viewers. So what happens when those viewers cut the cord? Do these cord cutters go to industry leaders like Disney or Netflix? Or do they instead go to Paramount+? In success, Paramount needs to convince current CBS viewers to come to Paramount+, not Netflix or Prime Video. While broadcast was all about “the prime demographic”, meaning viewers aged 18-49, for subscription streaming that’s less important, since older folks are more likely to actually pay the streaming bill. And frankly, CBS has the content to make it happen. Here are the top 10 shows on broadcast for the last season in terms of total viewers: I’m cautiously optimistic that some execs at Paramount see this angle. The Yellowstone spinoffs are perfect fodder for the CBS crowd. Paramount+ has announced a Criminal Minds reboot, and the older episodes are about to leave Netflix. It also brought over SEAL Team from CBS too. Paramount+ has mostly avoided the siren song of “prestige” TV, focusing on genre — Star Trek times a thousand, Halo — and turned its attention to reboots and remakes of other genre fare. Let HBO, Hulu, Netflix, Apple and Prime Video fight for prestige TV viewership (and Emmy awards). Own the cheaper procedurals at Paramount+ and you just might serve a large, under-served segment. Step 4: Conquer the Globe 🌎Another media-neglected part of Paramount+’s strategy has been to partner with global groups. Consider these headlines: I like this strategy, especially as every streamer tries to launch streaming services globally simultaneously. For all the touted benefits of global distribution, launching a global streamer is expensive! Paramount has aggressively partnered with local content distributors everywhere, from South Korea to almost all of Europe. Paramount also did a big joint venture in India that just won IPL sports rights, as I wrote about last week. If this strategy works, it could pay dividends for Paramount. This could turn out to be the best way to boost returns on content investment without having to bear the risk all by yourself. Step 5: Find a Few More Film Franchises 🕵🏻♀️Folks forget that Disney’s dominance at the box office is a fairly new phenomenon: Warner Bros. arguably won the 2000s, while the 1990s were up for grabs. Meaning if Paramount makes the right moves, it’s not crazy that it could be the “it” studio of the 2020s. In his excellent Ankler feature “State of the Slate,” Jeff Sneider ran through the options facing Paramount’s film side. With a few lucky breaks, Paramount could easily have a few franchises that compete with Disney, Warner Bros. and Universal each year. Assume Top Gun is already a hit and then add…

Imagine a world where D&D surprises folks a lá Jumanji, Star Trek rebounds with fans and Transformers takes back it’s strong global performance, then it’s not crazy to see a world where Paramount has two to three reliable franchises each year. Toss in the Sonic, Paw Patrol, and SpongeBob kid movies, and that’s not half-bad! Paramount could use a few more reliable franchises to really help their slate. But building those from scratch is tough. And I have a recommendation for that…keep reading… Conclusion: So Who Buys It? Or What Does Paramount+ Buy?Say we are in the unlikely — remember, call this a 10 percent chance of happening — scenario where Paramount+ has grown its streamer, spun off some cash, and presumably paid down its debt. This would be driven by keeping its stop spot on linear TV while firmly entering the “top tier” of subscription streamers, currently Netflix, Disney+/Hulu, WBD and Prime Video. In that case, who buys Paramount? I mean, that’s really the question for all of streaming. Everyone wants Shari Redstone to sell her company and its assets to Comcast, merge with Warner Bros. Discovery or make some other deal. But honestly, in success, Paramount Global could be too expensive to buy (and antitrust authorities could prevent another mega-deal). Instead, I’d like to see Paramount figure out a way to do one more acquisition. Specifically tiny old Lionsgate, especially after Lionsgate spins off Starz. Adding the John Wick franchise, the Saw films, and maybe a reboot of the Hunger Games and Twilight films could really fill out Paramount’s film and TV slates. Paramount has too much debt, so it would have to buy Lionsgate using all stock, but Lionsgate is small enough that I think the deal could make sense for both sides. Will Paramount Global take over the entertainment industry in the next five to 10 years? Maybe, maybe not. But could they? There’s a path. Which is probably more credit than most folks give them. New on The Ankler

|

Paramount's Best-Case Scenario

June 23, 2022

0